If you’re a small business owner, you have to file taxes every year. Learning how to file dozens of tax forms with unique due dates and schedules can be overwhelming. Small business owners also need to avoid mistakes that incur penalties and stay on top of deductions. For a small business, taxes are stressful, to say the least.

Whether you need filing advice or accounting software , we’re here to help. This streamlined guide explains the 25 most important small business tax forms. By reviewing these forms and their tax dates, you’ll learn how to file taxes for a small business.

We recommend reading through the entire article to learn the ins and outs of taxes for small businesses. You can also use the menu below to skip to the business tax form that’s most important to you:

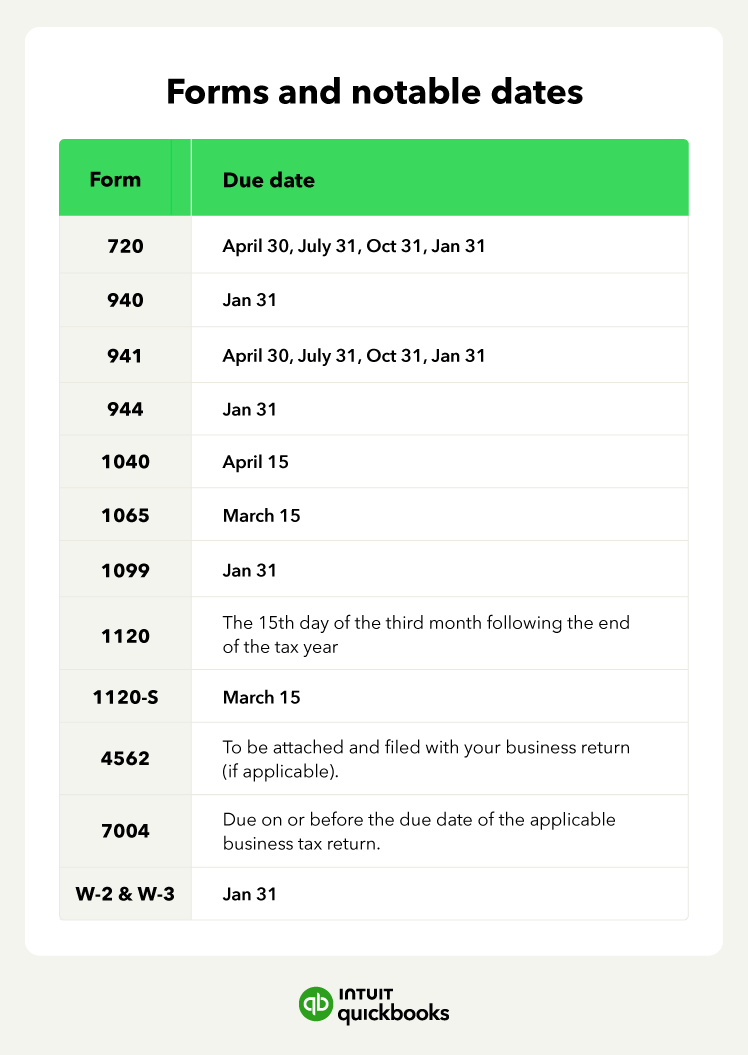

Businesses that pay federal excise taxes file Form 720 every quarter . Businesses pay excise tax on specific goods and services manufactured or imported into the US More specifically, excise refers to tax obligations incurred when a good is manufactured instead of when it’s sold.

Substances covered by excise tax include:

Businesses use Form 720 to report the excise taxes on certain business activities.

Businesses that sell products or services with excise tax liability should use Form 720.

Notable dates: The IRS wants Form 720 by the last day of the month following the end of a quarter. For large and small businesses, quarterly taxes must reach the IRS or receive a postmark by:

Form 940 determines the amount you contribute to unemployment insurance as an employer. This helps employees who leave a job for reasons beyond their control receive unemployment insurance. You only need to submit Form 940 once a year, but you must pay your FUTA tax payments quarterly.

Businesses use Form 940 to report annual Federal Unemployment Tax Act (FUTA) taxes. This tax funds unemployment benefits to workers who lose their jobs.

Employers who meet either of the following criteria must file:

Notable dates: You must file Form 940 by Jan 31. However, if you deposited all FUTA tax when due, the deadline extends to Feb. 12, 2024.

On Form 941 , businesses report payroll information on salaries, wages, tips, and taxes. The form also lets employers pay their portion of Social Security or Medicare tax. Companies must file Form 941 quarterly.

Businesses use Form 941 to report employee wages, tips, and tax withholding information.

Any business that pays wages subject to federal income tax withholding or Social Security and Medicare to an employee must file the form quarterly.

Notable dates: Your Form 941 is due by the last day of the month that follows the end of the quarter:

If your business qualifies as a semiweekly depositor, you need to file Form 941 with Schedule B. The IRS considers you a semiweekly depositor if:

Schedule B is attached to Form 941. It reports the employer’s quarterly tax liability for withholdings on a daily basis.

Form 944 is a small business tax form that works like Form 941, except you can file once a year instead of quarterly. Businesses with annual liability for Social Security, Medicare, and withheld federal income taxes of $100 or less are eligible to report federal income with this form. This form also allows them to calculate their social security and medicare tax liability. With this form, you can avoid confusion over small business tax dates.

Form 944 helps small businesses simplify their filing process by filing once a year.

Businesses with a tax liability below $1,000 can file Form 944. Note that if the IRS notified you in writing to file Form 944, you must file it even if your tax liability for 2023 exceeds $1,000.

Notable dates: The due date for filing Form 944 is Jan 31. However, if you made deposits on time in full payment of the taxes due for the year, you can file it by Feb 12.

US taxpayers use Form 1040 to file their annual income tax return. Business owners and employees can also declare their filing status, take tax deductions , claim credits, and determine how much they owe the IRS. Unlike other tax forms, almost everyone files Form 1040.

Business owners and employees use Form 1040 to report profit and loss.

Everyone who earns income, except tax-exempt individuals, must file Form 1040.

Notable dates: The due date for filing Form 1040 is April 15.

While Form 1040 can cover an individual's profit and loss, it can't accommodate sole proprietors. For this form, self-employed business owners can use different schedules to provide more information. The most popular ones include:

Schedule C reports income or loss from a business you operated or a profession you practiced as a sole proprietor. Note that if your business is a sole proprietorship , you need to attach Schedule C to your Form 1040 each year.

Form Schedule C allows you to report your income and all related expenses to the IRS.

Use Form 1040-ES to calculate and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding. Examples include:

Taxpayers must submit quarterly payments by:

If the due date for an estimated tax payment falls on a Saturday, Sunday, or legal holiday, you can make on-time payments by the next business day.

Schedule SE calculates Social Security and Medicare taxes due on net earnings from self-employment . All self-employed individuals must file Schedule SE.

We can help you with extension filing before tax deadlines to avoid penalties.

Save time by seamlessly moving from books to taxes in QuickBooks, then file your return with unlimited expert help and your maximum refund.*

Start hereForm 1065 , also known as the US Return of Partnership Income, declares business income or loss. If you file as a partnership or a multimember LLC electing to be treated as a partnership, you’ll file Form 1065 each year to declare profits, losses, deductions, and credits.

Partnerships and multimember LLCs use Form 1065 to report income.

Businesses structured as partnerships need to file Form 1065.

Notable dates: The due date for filing form 1065 for calendar year partnerships is March 15.

Business owners file Schedule K-1 to report their share of the partnership's income, deductions, and credits.

Businesses send Form 1099-NEC to independent contractors whom they paid at least $600 within a calendar year. It reports contractor income similar to how Form W-2 reports employee income.

Form 1099 reports pay to independent contractors.

Any business that hires a freelancer or contractor must file a 1099-NEC .

Notable dates: Businesses must send 1099-NEC to contractors by Jan. 31

While Form 1099-NEC focuses on contractors, other IRS Schedules account for other types of income. 1099s can fall into different categories that can include dividends, interest, and other forms of income.

The most popular ones include :

Form 1120 , also referred to as the US Corporation Income Tax Return, reports corporate income or losses. If your business files taxes as a regular corporation, you need to file Form 1120 each year.

Corporations use Form 1120 to report profit or loss.

C Corporations and LLCs that elect to file as a C corporation must file Form 1120.

Notable dates: The due date for filling Form 1120 is the 15th day of the fourth month after the end of the corporation’s tax year.

S Corporations and LLCs that file as S-Corps submit Form 1120-S to report on income or losses. Unlike C-Corps, S corporations don’t face double taxation. Instead, profits pass through to owners and the 1120-S accounts for this tax difference. Because filing as an S-Corp only incurs one round of income taxes, most small businesses prefer this approach.

Form 1120-S is used for reporting S corporation profit or loss.

S Corporations and LLCs that elect to file as an S corporation.

Notable dates: The due date for filing Form 1120-S is the 15th day of the third month following the end of the tax year

Form 2553 allows LLCs and sole proprietors to elect S-Corp tax status and file an 1120-S for earnings. Businesses that file Form 2553 must meet the legal requirements for running an S corporation.

Form 2553 is used for registering your business as an S-Corp for tax purposes.

LLCs and sole proprietors who want to file as an S corporation must file Form 2553.

Notable dates: Form 2553 has no formal due date. For the election to take effect during a particular tax year, you must file:

You would file Form 4562 to report depreciation and amortization expenses from your trade or business. Form 4562 commonly reports depreciation and amortization of business property such as:

Form 4562 is used for reporting deductions for depreciation and amortization.

You must file Form 4562 if you are claiming any of the following:

Notable dates: Businesses attach and file Form 4562 with their applicable business return.

Businesses use Form 7004 to request an extension on their tax filing due date.

Business owners use Form 7004 to request an extension on income tax returns.

Businesses don’t have to submit this form unless they seek a tax filing extension.

Notable dates: Due on or before the due date of the applicable business tax return.

Form 8829 deducts eligible living costs like rent and utilities as business expenses. Business owners who work from home—partially or full-time—will find Form 8829 helpful for identifying which expenses qualify as tax deductible.

Note: The IRS is very specific about which costs you can deduct and what constitutes a workspace. So, do your research or consult a tax professional before claiming deductions.

Use Form 8829 to deduct expenses for business use of your home.

Form 8829 isn’t a required document. However, self-employed workers who create a workspace in their homes may file. Because working from home incurs business expenses, filing this form cuts operational costs.

Notable dates: Form 8829 has no formal due date. Instead, it’s filed with a Schedule C and your 1040.

Limited Liability companies use Form 8832 to change their default tax classification. By default, the IRS taxes LLCs like partnerships or proprietorships. With this form, LLCs can file as a corporation instead.

Use Form 8832 to change your LLC’s tax status.

LLC owners only need to file Form 8832 if they want to change tax status.

Notable dates: Form 8832 has no formal deadline. However, the sooner you submit the form, the sooner your new tax classification applies.

New businesses use Form SS-4 to apply for an employer identification number (EIN). An EIN is a nine-digit number that the government assigns to employers, sole proprietors, corporations, and partnerships for tax filing and reporting purposes. It functions as a unique identification number for your business.

Businesses use Form SS-4 to receive an EIN tax ID.

Partnerships and corporations need an EIN to operate legally must file Form SS-4. Sole proprietors may also choose to file with an EIN.

Notable dates: Businesses can apply for an EIN anytime.

Send Form W-2 to each of your employees; this form reports their annual wages and the amount of taxes withheld from their paychecks. As a small business owner, you’re responsible for issuing this form to your employees no later than Jan. 31 and submitting copies to the IRS.

To streamline filing, employers can order printed W-2 kits for their employees.

Form W-2 is used for filing taxes on income earned from an employer.

All full-time employees must file Form W-2 .

Notable dates: The due date for filing Form W-2 is Jan 31.

Form W-3 is a business tax form that summarizes all the wages you paid to employees during the tax year.

Form W-3 reports combined employee income to the IRS and Social Security Administration.

Employers that pay employee wages need to file Form W-2.

Notable dates: The due date for filing Form W-3 is Jan 31.

Your employees fill out Form W-4 , which reports how much tax you—the employer—should withhold from their paycheck. Your employees may claim allowances for spouses or dependents on Form W-4. Employees may also instruct you to withhold more taxes from their pay if they work several jobs or if their spouse earns income, too.

Employees fill out Form W-4 to ensure employers withhold the correct amount of federal income tax.

All employees must file Form W-4, except:

Notable dates: There is no formal due date for W-4s. Instead, employees use Form W-4 to update their federal income tax withholdings at any time.

Independent contractors submit a W-9 form to share their Taxpayer Identification Number (TIN). The form may go to a person, financial institution, or business. Employers use contractors’ TINs to make sure they are in compliance with 1099 filing requirements. Contractors can submit an Employer Identification Number or their Social Security number as their TIN.

Form W-9 shares a contractor’s TIN with a business, bank, or other third party.

Independent contractors and freelancers must file Form W-9.

Notable dates: Form W-9 has no IRS deadline.

Between tax schedules, business structures , and filing dates, business owners should use every resource available. Thankfully, you can check out these blog posts to prepare for your filing:

While understanding and filing small business tax forms isn’t easy, you don’t have to do it alone. With the right tax software , you can streamline filing and ensure accurate bookkeeping. From there, you can discover new deductions, update your financials, and enjoy peace of mind during tax season.

With QuickBooks, get every tax deduction you deserve.Disclaimers

*QuickBooks Live Tax, powered by TurboTax, is an integrated service available with a QuickBooks Online subscription. Additional terms, conditions and limitations apply. Pay when you file.

**QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a Live Bookkeeper. Available to new QuickBooks Online Simple Start, Essentials, Plus, or Advanced subscribers who are within their first 30 days of their subscription. The QuickBooks Live Setup service includes instructions on how to set up your chart of accounts, customize invoices, set up reminders, and connect bank accounts and credit cards. QuickBooks Live Setup does not include Payroll setup or services. Your bookkeeper will only guide you through the setup of your QuickBooks Online account, and cannot set it up on your behalf.

Terms and conditions, features, support, pricing, and service options subject to change without notice.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Recommended for you

How to write off travel expenses: A complete guide on business travel expenses

February 14, 2024

How to file small business taxes: A 7-step guide

January 11, 2024

8 common tax audit triggers to avoid

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.