A humble abode. Your dwelling and domicile. Home sweet home. There’s nothing like it—it’s the best.

But what if something happened to it? Do you have the right homeowners insurance to make sure you can start over? How do you know? What exactly does homeowners insurance cover? And what doesn’t it cover?

Insurance might be complicated, but it’s not rocket science. Don’t let a simple lack of knowledge keep you from protecting your home and your finances. The reality is that many homeowners are underinsured—and they’re taking big risks they likely can’t afford.

In this homeowners insurance guide, I’ll break down everything you need to know about homeowners insurance.

Key Sections:

Homeowners insurance is financial protection for your home and personal belongings in case of accidents, fires or other disasters. It protects you from financial ruin by transferring risk to an insurance company. Homeowners insurance also protects you financially from lawsuits due to accidents on your property (think dog bites or other injuries).

Here’s how it works. By paying monthly premiums, you enter into a contract with your insurance carrier. Your insurance company then agrees to pay for any incidents they’ve agreed to cover. If one of those incidents happens, you file a claim and pay a certain amount of the damages out of pocket (your deductible), then your insurance company pays any costs above your deductible, up to the policy’s limit.

The bottom line? If you own a home, you need homeowners insurance. In fact, almost all mortgage companies require you to have homeowners insurance, even though it’s not required by any state laws. Even if you rent, a lot of landlords require you to have renters insurance to protect your stuff.

Would you be okay financially if (God forbid) a tornado came along and destroyed your home? If the answer’s no (and it is for most of us), you need a homeowners insurance policy. Homeowners insurance provides peace of mind knowing you won’t be wiped out financially if your property is.

Here are the different areas where a homeowners policy provides peace of mind:

Maybe you’re looking into buying your first home. (Congrats are in order, if so!) And you’re thinking, This deal is already so expensive—do I have to get homeowners insurance? Here’s the thing about buying a home: Most people get a mortgage. And the banks that give you that mortgage require homeowners insurance.

After all, until you pay off your mortgage, the bank actually owns your house—and they don’t want their collateral going up in smoke.

Now, if you pay cash for that sweet bungalow, you can do whatever you want. But I’m still going to recommend you get homeowners insurance that covers the entire cost to replace your house—unless you’ve got some Scrooge McDuck-level money and you could pay for it without flinching. But I doubt it.

Let’s get this straight: Homeowners insurance is not the same thing as a home warranty. A warranty is a guarantee against something in the house, like a refrigerator, turning out to have a problem. Home insurance is a guarantee against something having a problem with the house—like a tornado.

A home warranty pays to repair or replace a broken appliance or HVAC system, for example. Home insurance would pay to repair or replace damage to your home caused by a fire.

Home Insurance vs. Home Warranty

Home Insurance

Home Warranty

Pays to repair or replace house structure and contents if damaged or destroyed by covered incident

Pays to repair or replace some appliances and home systems if they break down

Policies last for one year and are renewed each year

Warranties typically last for one to two years

Does not cover problems from construction, wear and tear, poor maintenance, or faulty installation

Does not cover problems from construction, wear and tear, poor maintenance, or faulty installation

Comes with varying levels of coverage; best level pays full cost to replace everything

Pays partial cost for repairs or replacements

(If you’re researching homeowners insurance because you’re just starting to shop for a home, check out our free Home Buyers Guide.)

When it comes to home ownership, there’s a lot to keep track of, so don’t feel bad if your head is spinning . . . but there’s one more issue I’ve got to clear up. Home insurance and mortgage insurance are not the same thing—in fact, they’re very different. While home insurance kicks in if your actual home and stuff are damaged, mortgage insurance is a kind of life insurance that pays off your mortgage if you die.

You definitely want home insurance, but if you have level term life insurance (the only kind of life insurance I recommend) you don’t need mortgage insurance! It’s about as good a deal as anything you’d buy off a TV infomercial after 1 a.m.

Homeowners insurance is a lot like porridge. Hear me out.

You need to make sure you’re in that Goldilocks sweet spot of homeowners insurance coverage—not too much coverage and not too little. Like most types of insurance, homeowners insurance isn’t just one blanket policy that covers everything. It’s a lot more complicated than that (and why getting educated is so important).

Let’s start with what homeowners insurance covers so you can understand where you’re protected. Pro tip: Your insurance declaration page will show you what coverages you currently have so you can see where the gaps are.

A typical homeowners insurance policy addresses five basic things.

This coverage pays to repair or rebuild your dwelling (aka your house and anything attached to it) due to damage from disasters like fire, windstorms, hail, lightning, theft and vandalism (also known as hazards). So, if a tornado politely takes the lid off your house and puts it in a tree, dwelling coverage will kick in and your insurance company will pay to replace it. However, there are a few exceptions to homeowners coverage, like damage from flooding and hurricanes (more on that in a bit).

Other structures coverage applies to things other than your house. Some examples are: detached garage, tool shed, barn, gazebo, swimming pool, fence or driveway.

Basically, any structure that is a permanent, valuable feature of your property falls under other structures coverage. But it does have limits—usually around 10% of the total policy you have on your house.

Most good policies cover your stuff anywhere in the world—like in a storage unit, in your car, or in your suitcase when you’re on vacation.

Personal property coverage protects what’s in your home—the stuff you use every day, like clothes, furniture and electronics. It also covers expensive stuff like jewelry, art and collectibles. But there’s often a dollar limit attached to those high-end items—so make sure you have enough insurance to replace everything. Most insurance companies cover your belongings at around 50–70% of what your house is worth. Create a thorough inventory of all your things so you have a record of your belongings and what they’re worth.

Personal liability protection covers you from lawsuits for bodily injury, property damage that occurs on your property, and even dog bites if Rex isn’t a dangerous breed (although there’s always the possibility he’ll lick you to death). Personal liability coverage doesn’t cost much, so you can get plenty at a reasonable rate. You should carry at least $500,000 in liability because—let’s be real—no one these days sues for $250,000. And if you have a larger net worth, you should also look into umbrella insurance.

Additional living expenses (ALE) coverage helps pay for the costs of living away from home when you can’t stay there due to damage from an insured disaster. Whether it’s for a few days or even months, ALE covers things like hotel bills, restaurant meals, pet care, transportation and even moving expenses.

However, ALE won’t pay for all your expenses. It covers costs over and above your usual living expenses (like your mortgage and regular grocery budget).

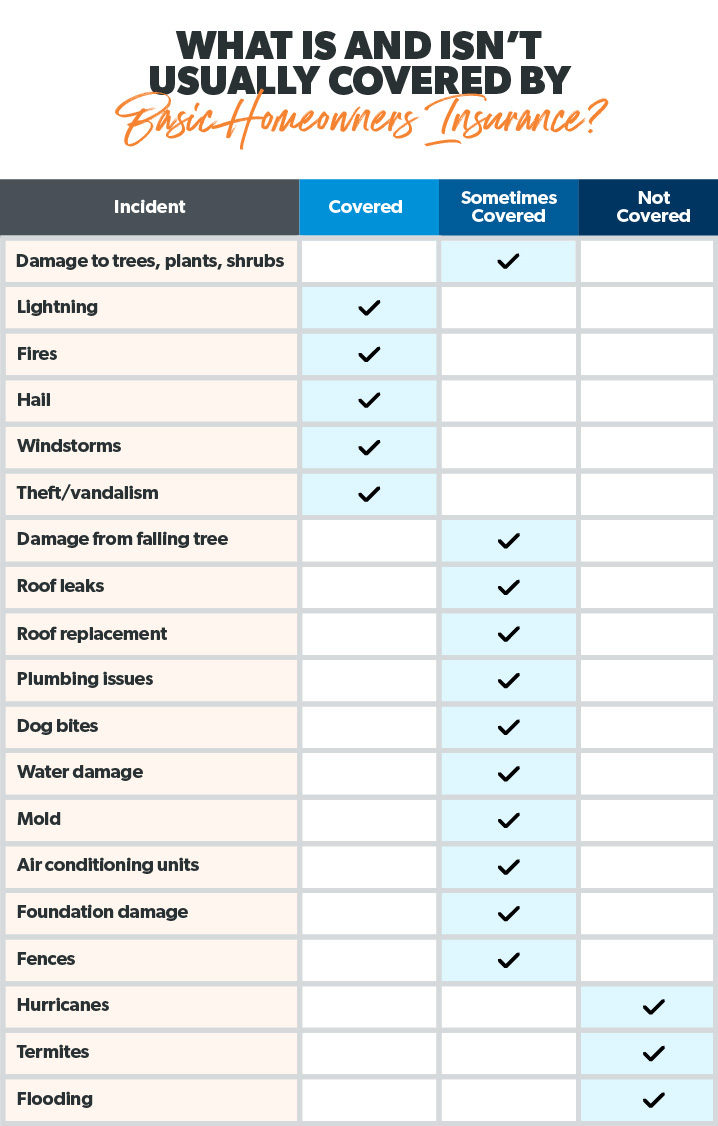

Now that we’ve seen the good news of what a typical homeowners insurance policy covers, we’re ready for the bad news—what’s not covered.

You should carry at least $500,000 in liability because—let’s be real—no one sues for $250,000. And if you have a larger net worth, you should also look into umbrella insurance.

What’s not covered by standard homeowners insurance? And when should you consider buying additional coverage? Let’s take a look.

Of all natural disasters in the U.S., 90% involve flooding. 1 Only 78% of homeowners who report being at risk of flooding say they have flood insurance though. 2 (Come on, people! Let’s turn these numbers around.)

I’m going to be as crystal clear as I can on this one: Standard homeowners insurance policies won’t cover flood damage to your home.

And, no, you can’t call the insurance company while you’re standing knee-deep in water (nice try). You need flood insurance before the waters start rising. It’ll pay for damage to the structure of your home and anything attached to it.

Keep in mind, we’re talking flood waters from outside your home. Home insurance will cover some kinds of water damage like roof leaks.

If you live in a flood-prone area, get flood insurance. Now.

Basic homeowners insurance also won’t cover damage from earthquakes, unless it’s something like a house fire caused by an earthquake (look at your policy or check with your insurance agent for a full list of covered hazards). So if you live on the San Andreas Fault or another earthquake-prone area, you’ll want to look into adding earthquake insurance.

What about hurricanes? If you live in a susceptible coastal area, dwelling coverage won’t cover wind or flooding damage caused by a hurricane. You’ll need a separate policy for that.

Homeowners policies typically don’t cover sinkholes—unless you live in Tennessee or Florida. Insurers in these two states are required to offer optional sinkhole protection. If you live in a state where sinkholes are common—like Tennessee, Florida, Alabama, Kentucky, Missouri, Texas and Pennsylvania—you might want to consider this extra protection. 3

In most cases, your homeowners insurance won’t cover damage caused by termites, mold, poorly maintained water pipes and sewage backups. Instead, these are considered part of the regular maintenance of owning your own home. Just like your car insurance doesn’t pay for oil changes and your dog doesn’t make his own dinner, your homeowners insurance company won’t pay to maintain your house. (Welcome to the “joys” of adulthood.)

This is why it’s important to stay up on your home maintenance. Deal with those small issues before they get big—and costly! It’s also smart to save up an emergency fund and get out of debt so you’ve got extra cash to cover things that break (because things always break).

Okay, we’ve covered a lot of information, but this stuff can be pretty confusing. So let’s go over a few common scenarios that are and aren’t covered by homeowners insurance.

Covered

A nasty thunderstorm hits. The wind whips the rain up into your eaves, and it gets into your attic. Now you have water damage in your attic and a corner of your ceiling. Home insurance will cover this.

Not Covered

A spring thunderstorm breaks loose over your house, dropping three inches of rain in an hour. Your gutters are clogged with leaves because playing pickleball with your friends sounded way more fun than clearing them out. Rainwater overflows into your house interior, damaging your ceiling and attic. Insurance won’t cover this because blocked gutters is considered a maintenance issue and home insurance doesn’t cover problems caused by poor maintenance.

Covered

You throw a load of laundry into the washing machine before heading out to pick the kids up from school. When you get back, the kids scream with joy because the laundry room and kitchen are now a shallow swimming pool. Your washing machine hose burst and flooded the house! This is covered by home insurance.

Not Covered

It’s been an unusually wet spring, and the river is overflowing. It starts raining again and the water creeps up higher into your house. This is not covered by homeowners insurance. You need flood insurance for this.

Now, let’s talk about the different types of homeowners coverage.

Choosing the right kind of homeowners insurance is crucial. And it’s a balancing act. You want the most protection at the best value—without being underinsured or paying high premiums for coverage you don’t need.

Let’s look at four main types of homeowners insurance.

An actual cash value (ACV) homeowners policy will pay to repair or replace your personal belongings, minus depreciation. So, let’s say somebody steals your Peloton (which would be impressive considering those things are heavy as heck). The insurance company will pay what the Peloton was worth when it got stolen—not when it was new in the box.

In most policies, ACV applies to your personal property, but it can also apply to how your home structure will be replaced as well.

Replacement cost coverage offers more protection than actual cash value because it doesn’t consider depreciation. It’ll pay to repair or replace your home at today’s prices up to the limit. For example, if you have $200,000 in dwelling coverage and the rebuild costs $250,000, you’ll have to pay $50,000 plus your deductible.

A standard homeowners policy usually offers RCV coverage for dwelling and the option of choosing either RCV or ACV coverage for your personal property. I recommend getting RCV coverage in both cases!

Guaranteed replacement cost coverage pays the full replacement cost if your home is destroyed—without factoring in depreciation or dwelling coverage limits. So if the rebuild costs $250,000, that’s what the insurance company will pay (minus your deductible). Simple. The only downside is that it’s very expensive and harder to find than a dress shirt that doesn’t fit like an actual dress on me.

Another variation on replacement cost coverage is extended replacement cost coverage. This type of homeowners insurance pays the replacement value of your home up to the coverage limit—plus a percentage of the coverage limit. So, following the example of $200,000 in coverage with a $250,000 cost to rebuild, an extended replacement cost policy could cover $200,000 plus 10% of that limit (another $20,000).

This coverage is also more expensive. But it can be helpful if you live in an area where construction costs are rising quickly (which seems to be nationwide in the last few years) and your home is at relatively high risk of being damaged.

Not everybody’s got the same kind of home. Just look around. You might live in a modern ranch spread, but the lady down the street is in a historic Tudor Revival, while your friend owns a condo and your uncle is a landlord. Good thing homeowners insurance policies come in different types!

HO-1 and HO-2: Think of these as the Speedos of home insurance policies. They offer only bare-bones coverage—much less than what you would generally want as a homeowner.

HO-3: This is the most common type of policy homeowners selected. Keeping with the swimwear analogy, these offer 1960s-swim-trunks-length coverage (you know, the ones where you wonder, Are we sure those qualify as shorts? I’m still seeing more leg than I ever cared to). They come as either a named perils policy (you’re only covered for what’s on a list of specific incidents—not great) or an all-inclusive policy (which covers everything except what’s listed). Your personal property is protected up to a limit (usually 50% of your dwelling coverage).

These policies typically come with actual cash value (ACV) coverage for all your stuff. This means you get paid what your property is worth at the time it was damaged or destroyed (aka the used value, which includes depreciation). Not ideal.

HO-4: This is renters insurance. It covers everything the renter owns and offers personal liability coverage in case anyone is injured on the property.

HO-5: Along with HO-3, this is the other policy that the owner of a single-family home would buy. These policies are your full-on, early-2000s, below-the-knee swim trunks (which I hope never to see again—they swallow us little fellas. But when it comes to home insurance policies, they look pretty rad). They offer the highest levels of coverage and are more expensive. But they’re worth it because if your home and belongings are ever destroyed, you’ll be starting over, and you’ll need all the help you can get.

With this kind of policy, you’ll get replacement cost value (RCV) coverage, which means your insurance will pay whatever it costs to replace your stuff. You may also be able to find a policy that has guaranteed replacement cost value.

HO-6: This is condo insurance. It covers your unit’s walls, floors and ceilings (but not the building itself—your condo association has a master policy for that) plus everything else a typical HO-3 policy covers, like liability and personal property.

HO-7: Folks who live in a mobile home or manufactured home need this kind of policy. Coverage usually only applies when your home isn’t moving.

HO-8: This policy is designed to cover the proud owners of a historic home. They’re expensive because old homes aren’t usually built to current codes and standards, and repairs require special expertise and materials. (If you break a window George Washington looked out of, you have to replace it with another window George Washington looked out of, and that gets expensive.) It also provides the other typical coverages, like liability and personal property.

Having a RamseyTrusted pro by your side means you’ll get quality insurance coverage without breaking the bank.